Trading

Trading Rights

- Trading rights are assigned to individual traders based on market characteristics. Not all traders have the same trading rights. For instance, all traders have trading rights in our political markets, but only traders with academic affiliation can trade in the returns markets. When you log in, IEMXchange reads your trading rights and builds a trading screen for you that reflects those rights. The information below describes general trading rights that may be available to you. If you do not have the right to perform a particular function, your screen will not list that function.

Markets and the Objects Traded

- IEMXchange contains many markets. A market is defined by sets of trading rules, traders, assets, and information. The characteristics of a specific market are defined in its prospectus. Each market is related to some future event. This future event determines how assets in the market will payoff. Generally, the market name contains a description of how these payoffs are determined. The most common of these are Winner-Takes-All, Vote-Share, and Linear-Returns markets. An asset is any object traded in a market. Once an asset is opened for trade, it will remain in circulation until it is liquidated. Specific rules related to asset splits, dividends, retirements, liquidations, and trading times are described in the market prospectus.

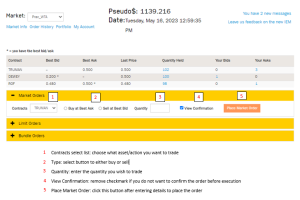

Placing Market Orders

- Market orders are requests to buy or sell assets at the current ask and bid prices. A market order consists of:

- an instruction to buy or sell

- an asset ticker symbol

- the quantity you wish to trade

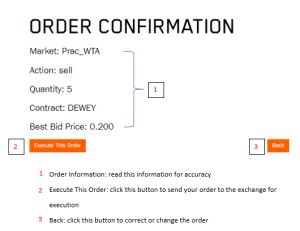

To place a market order, use the market order menu (denoted “1” in the picture above). Choose the asset you wish to buy or sell from the Action/Asset select list, whether you wish to buy or sell (“2” in the picture above), specify the quantity (“3” in the picture above), and then click on the Place Market Order button (“5” in the picture above).

By default, you will be asked to confirm your market order before it is executed. If you wish to eliminate this confirmation step, remove the checkmark from the “View Confirmation” box (“4” in the picture above) before clicking on the “Place Market Order” button.

Your market order will be executed one unit at a time. If you are buying an asset and do not have enough cash to purchase the entire number of assets you requested, the order will be processed until you run out of cash. Similarly, if you are selling assets, your order will be processed until you run out of the assets you are selling.

Market Orders are executed against your account in one-unit increments. Before each unit is traded against your account, your asset and cash holdings rechecked to be sure that you have enough assets and cash to continue the trade. When the remaining portion of a trade becomes infeasible, that portion is cancelled and marked infeasible.

To see a list of all orders that you have placed for a particular asset, use the My Account button at the top of your IEMXchange screen.

Market Price Bundles

A market-price-bundle is a set of assets that will trade simultaneously at their respective market prices. The assets included in a particular market-price-bundle are defined in that bundle’s description in the market prospectus.

Market-price-bundles initiate trades at current market prices (current bids if you place a sell order, current asks if you place a purchase order). The only difference between trading a market-price-bundle and trading its components individually is that the market-price-bundle guarantees that all components of the bundle will trade or no components will trade.

Market-price-bundle orders are subject to the same feasibility checks that are associated with market orders (purchase and sell orders) for individual assets. If a feasibility check fails for any asset in the market bundle, then the bundle will not trade. This means:

- To sell a market-price-bundle, you must own at least one unit of each asset in the

- To buy a market-price-bundle, you must have enough cash to purchase all the assets in a market bundle at their current asks.

- If one or more of the assets in the market-price-bundle do not have current ask prices, you will not be able to purchase a market bundle.

- If one or more of the assets in the market-price-bundle do not have current bid prices, you will not be able to sell a market bundle.

- Self trades are not allowed. If you attempt to trade a market-price-bundle against one of your own bids or asks, that bid or ask will be cancelled. IEMXchange will continue to try to trade your market order after self trades are cancelled. If other traders have orders in the queue at the same price as your bid or ask, your market order may be traded against

Your bundle order will be executed one bundle at a time according to the feasibility checks described above. Market bundle orders that cannot be completed are cancelled.

Changes in Current Bid and Ask Prices:

Like market orders for individual assets, market-price-bundles trade at current market prices when your order reaches the exchange. If prices change between the time you place your order and the time it reaches the exchange, you order will trade at the new prices.

You can protect yourself from unanticipated price changes by using the confirmation option when you submit a market order. Placing a checkmark in the confirmation box tells IEMXchange to check prices before executing the order. IEMXchange will then confirm that the price at which your order will trade is not worse that the price you saw when you confirmed the order. For purchases of market bundles, this means that the total price you pay for the order will be no higher than the price you confirmed. For sales of market bundles, this means that the total price for which you sell the bundle will be at least as great as the price you confirmed.

Fixed Price Bundles

A fixed-price-bundle is a set of assets which can be purchased from or sold to the exchange at a fixed price. This fixed price is the guaranteed aggregate liquidation value of the assets.

So that the IEM neither makes nor loses money, assets are placed in circulation by issuing fixed-price- bundles. For instance, a fixed-price-bundle containing 2 assets whose liquidation values will sum to $1.00 can be purchased from the exchange or sold to the exchange for $1.00.

To purchase or sell a fixed-price-bundle, use the market order menu. Choose the bundle name, specify the quantity you wish to trade, and click the ” Place Market Order” button.

Your bundle order will be executed bundle by bundle. If you are buying bundles and do not have enough cash to purchase the entire number of bundles you requested, the order will be processed until you run out of cash. Similarly, if you are selling bundles, your order will be processed until you run out of the assets necessary to form complete bundles. Incomplete and partial bundles will not be processed.

Once bundles are purchased, they can be split up and each asset traded individually. Or, complete bundles can be resold to the exchange for the fixed bundle price.

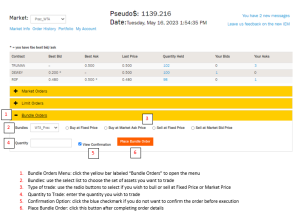

Placing Bundle Orders

To place a bundle market order, use the bundle order menu (denoted “1” in the picture above). Choose the asset you wish to buy or sell from the Bundles select list (“2” in the picture above), whether you wish to buy or sell at fixed price or market price (“3” in the picture above), specify the quantity (“4” in the picture above), and then click on the Place Bundle Order button (“6” in the picture above).

By default, you will be asked to confirm your market order before it is executed. If you wish to eliminate this confirmation step, remove the checkmark from the “View Confirmation” box (“5” in the picture above) before clicking on the “Place Bundle Order” button.

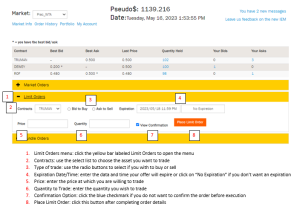

Placing Limit Orders

A limit order is a request to buy or sell an asset at a specified price for a specified period of time. A limit order consists of:

- an instruction to buy or sell

- an asset ticker symbol

- the quantity you wish to trade

- a price at which you are willing to trade

- an expiration date and time after which the order will not be traded

Limit orders that are not immediately executed are placed in queues for possible later execution. An order’s priority in the queue is determined by its price and when it was placed. Ask orders with lower prices are executed before orders with higher prices. When there are ties among prices, earlier orders are executed before later orders. Similarly, bids with higher prices are executed before those with lower prices, with earlier orders taking precedence over later orders. Limit orders remain in their queue until they trade, expire, become infeasible, or are withdrawn by the trader that placed them.

To place a limit order, use the limit order menu (labeled “1” in the picture above). Choose the asset you wish to buy or sell from the Action/Asset List (“2” in the picture above), specify if you want to buy or sell (“3” in the picture above), an expiration date and time (“4” in the picture above ), specify the price (“5” in the picture above), and the quantity (“6” in the picture above). Then click on the Place Limit Order button (“8” in the picture above) to submit the order.

By default, you will be asked to confirm your limit order before it is executed. If you wish to eliminate this confirmation step, remove the checkmark from the confirm box (“7” in the picture below) before clicking on the Place Limit Order button.

Limit Orders are executed against your account in one-unit increments. Before each unit is traded against your account, your asset and cash holdings rechecked to be sure that you have enough assets and cash to continue the trade. When the remaining portion of a trade becomes infeasible, that portion is cancelled and marked infeasible.

If you enter a limit order with a price which crosses the opposite queue, trades will take place at the prices listed in the opposite queue. For instance, if you enter a bid to buy 10 units at a price of $.50 and the price in the ask queue is $.45, trades will first be executed at $.45 until that price is no longer available. Then trades will be executed at the next highest price in the ask queue until that price is no longer available, etc.

If trades occur as the result of limit orders you have placed, the word “Trades” will appear in hypertext in the upper center of your screen. Click on this hypertext to see a list of trades that have taken place as a result of your limit orders in the market.

To see a list of outstanding bids or asks for a particular asset, click on the bid or ask hypertext on the right-hand side of the price screen. To see a list of all orders that you have placed for a particular asset, use the My Account button at the top of the IEMXchange screen.

Withdrawing Orders

You can withdraw any of your bid and ask orders as long as they have not traded or expired.

To withdraw an order, first access the market in which the order was placed. The market window displays each asset in the market; its right-hand side will show whether you have any outstanding bids and asks.

Click on the bid or ask hypertext to the right of the appropriate asset. Then find the order you wish to withdraw and click on the red x in the Cancel Order column to the right of the order. This will delete the order.

Once an order is deleted it cannot be retrieved.

Order Queues

Limit Orders are maintained in queues. Orders are listed in these queues in priority order. When a trade takes place, the order with the highest priority will be executed first, the next highest priority second, etc.

Bid orders with higher prices have higher priority than orders with lower prices. Within a particular price, older orders (orders that were placed sooner) have higher priority than newer orders.

Ask orders with lower prices have higher priority than orders with higher prices. Within a particular price, older orders (orders that were placed sooner) have higher priority than newer orders.

Only the highest priority bid and ask are shown on the trading screen. You cannot see other orders that other traders have placed in the queue. You can see orders that you have placed in the queue by clicking on the hypertext order quantity information in the market window. If the current best bid or ask is your order, an asterisk (*) will appear next it on your IEMXchange screen.

Short Sales and Margins

You cannot sell short or buy on margin. This means that you cannot hold negative inventories in assets or cash.

Trades are executed against your account in one unit increments. Before each unit is traded against your account, your asset and cash holdings rechecked to be sure that you have enough assets and cash to continue the trade. When the remaining portion of a trade becomes infeasible, that portion is cancelled and marked infeasible.

Feasibility Checks

Traders cannot not short sell assets or buy on margin. To enforce these restrictions, market orders are checked for feasibility before execution and limit orders are check for feasibility when they reach the top of their respective queues.

Market orders are executed one unit at a time. Each unit is checked for feasibility before it is executed. Infeasible portions of market orders are not traded.

Limit orders are checked for feasibility whenever they are at the top of their respective queues. So, all bids and asks that appear in the quote screens are feasible. This means that at least one contract can be traded at the stated bid or ask.

Bids and asks are checked for feasibility when:

- An order reaches the top of its queue

- An order is placed which would move to the top of its queue

- A trade takes place that could make an order at the top of its queue infeasible

Orders which reach the top of their queue and are found infeasible will be marked infeasible by the exchange and removed from the queue. A bid is infeasible if it reaches the top of the bid queue and the trader does not have enough cash to cover the purchase of at least one unit of the asset at the stated price. An ask is infeasible if it reaches the top of the bid queue and the traders does not have at least one unit of the asset in question.

Self Trades

You cannot trade with yourself. If you submit an order that would result in a self-trade, the exchange cancels the order in the opposing queue that would cause the self-trade and attempts to execute your order against other eligible orders in the queue.

Trades are executed against your account in one-unit increments. Before each unit is traded against your account, it is checked to see whether it would result in a self trade. If it would, the order in the opposing queue is marked infeasible and cancelled by the exchange, and order processing continues against any other available orders in the queue.

Spinoffs and Splits

The IEM Steering Committee can declare asset spinoffs and splits. A spinoff replaces an asset with two new assets. A split replaces an asset with several shares of the same asset. When a spinoff or split takes place, each share of the existing asset is retired and replaced with the new assets.

Asset Liquidations

The liquidation formula describes how and when assets will payoff. Once assets are liquidated, they can no longer be traded.

Liquidation formulas are described in the market’s prospectus. There are three general ways in which liquidation values are determined: Winner-Takes-All, Vote-Share, and Linear-Returns.

In a Winner-Takes-All market, exactly one asset will have a positive payoff and all others will expire worthless. For instance, a 3-asset market in which DEM pays $1.00 if the Democrats win the most popular votes, REP pays $1.00 if the Republican win the most popular votes, and ROF pays $1.00 is neither of these two things happen, is a Winner-Takes-All market.

In a Vote-Share market, liquidation values are determined by the candidates’ relative shares of the popular vote. In such markets, more than one asset can have a positive payoff. For instance, a 2-asset market in which DEM pays $1.00 times the Democratic share of the popular vote and REP pays $1.00 times the Republican share of the popular vote, is a Vote-Share market. If Democrats receive 50% of the popular votes, Republicans receive 40%, and a third party receives the remaining 10% of the vote, DEM will pay $.556 (5/9*$1.00) and REP will pay $.444 (4/9*$1.00).

In a Linear-Earnings market, liquidation values are determined by a linear function of reported annual earnings per share of a company. In such markets, more than one asset can have a positive payoff.